Featured

Table of Contents

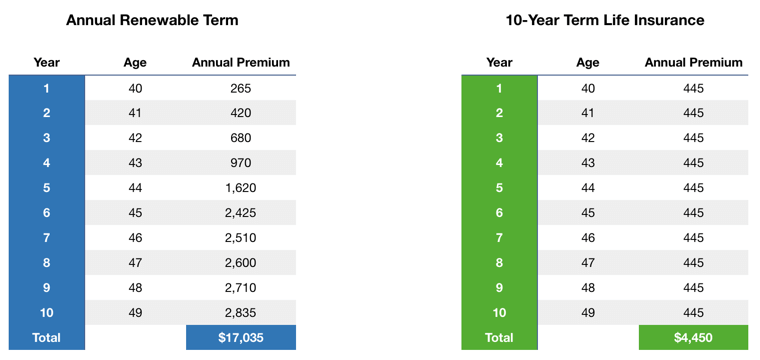

A level term life insurance policy can give you satisfaction that individuals who depend on you will have a survivor benefit during the years that you are preparing to sustain them. It's a method to aid care for them in the future, today. A level term life insurance coverage (often called degree premium term life insurance policy) policy offers protection for a set number of years (e.g., 10 or 20 years) while keeping the premium settlements the very same throughout of the plan.

With level term insurance policy, the cost of the insurance coverage will remain the exact same (or possibly decrease if returns are paid) over the regard to your plan, generally 10 or twenty years. Unlike long-term life insurance, which never runs out as lengthy as you pay premiums, a level term life insurance policy policy will certainly finish eventually in the future, normally at the end of the period of your degree term.

What is Increasing Term Life Insurance? Comprehensive Guide

Due to the fact that of this, many individuals make use of permanent insurance policy as a secure economic planning device that can offer several demands. You may be able to convert some, or all, of your term insurance coverage throughout a set period, typically the very first ten years of your policy, without requiring to re-qualify for protection even if your wellness has transformed.

As it does, you may want to add to your insurance protection in the future - Increasing term life insurance. As this takes place, you might want to eventually lower your fatality benefit or take into consideration transforming your term insurance policy to a permanent policy.

So long as you pay your costs, you can relax simple knowing that your enjoyed ones will certainly receive a fatality benefit if you pass away during the term. Lots of term plans permit you the capacity to convert to permanent insurance coverage without needing to take an additional health exam. This can enable you to make the most of the additional advantages of an irreversible plan.

Degree term life insurance policy is one of the simplest courses into life insurance policy, we'll review the advantages and drawbacks to ensure that you can pick a strategy to fit your needs. Degree term life insurance policy is one of the most typical and basic kind of term life. When you're looking for short-term life insurance policy plans, level term life insurance coverage is one route that you can go.

The application procedure for degree term life insurance policy is typically extremely uncomplicated. You'll complete an application which contains basic personal details such as your name, age, and so on as well as a much more detailed questionnaire concerning your case history. Depending upon the plan you're interested in, you might need to take part in a medical exam procedure.

The brief solution is no., for example, let you have the comfort of fatality advantages and can build up money value over time, indicating you'll have more control over your advantages while you're active.

What is Term Life Insurance With Accidental Death Benefit? Pros, Cons, and Features

Riders are optional provisions included to your policy that can offer you added advantages and protections. Anything can happen over the training course of your life insurance term, and you want to be prepared for anything.

This rider offers term life insurance coverage on your youngsters with the ages of 18-25. There are circumstances where these advantages are built right into your policy, however they can likewise be readily available as a different addition that needs added settlement. This rider supplies an additional death benefit to your beneficiary needs to you pass away as the result of an accident.

Latest Posts

What is Joint Term Life Insurance Coverage Like?

What is the most popular Level Term Life Insurance Rates plan in 2024?

Why is Level Term Life Insurance important?