Featured

Table of Contents

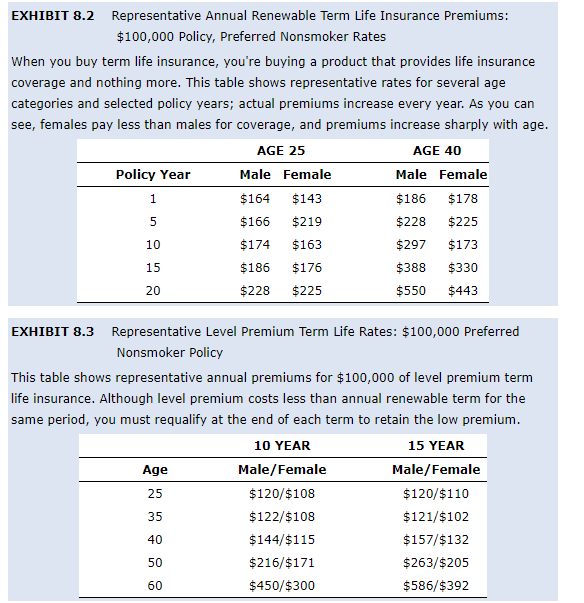

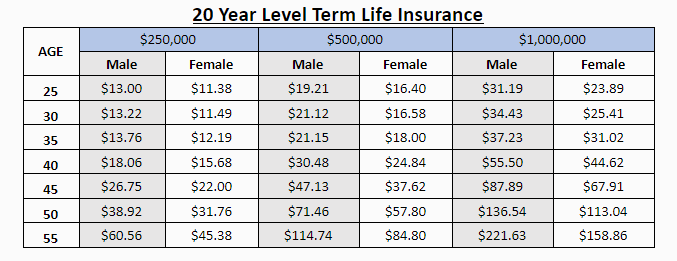

A level term life insurance policy policy can offer you satisfaction that individuals that depend on you will certainly have a survivor benefit throughout the years that you are preparing to support them. It's a means to assist care for them in the future, today. A degree term life insurance policy (occasionally called degree premium term life insurance coverage) plan provides protection for a set number of years (e.g., 10 or 20 years) while maintaining the costs settlements the very same throughout of the plan.

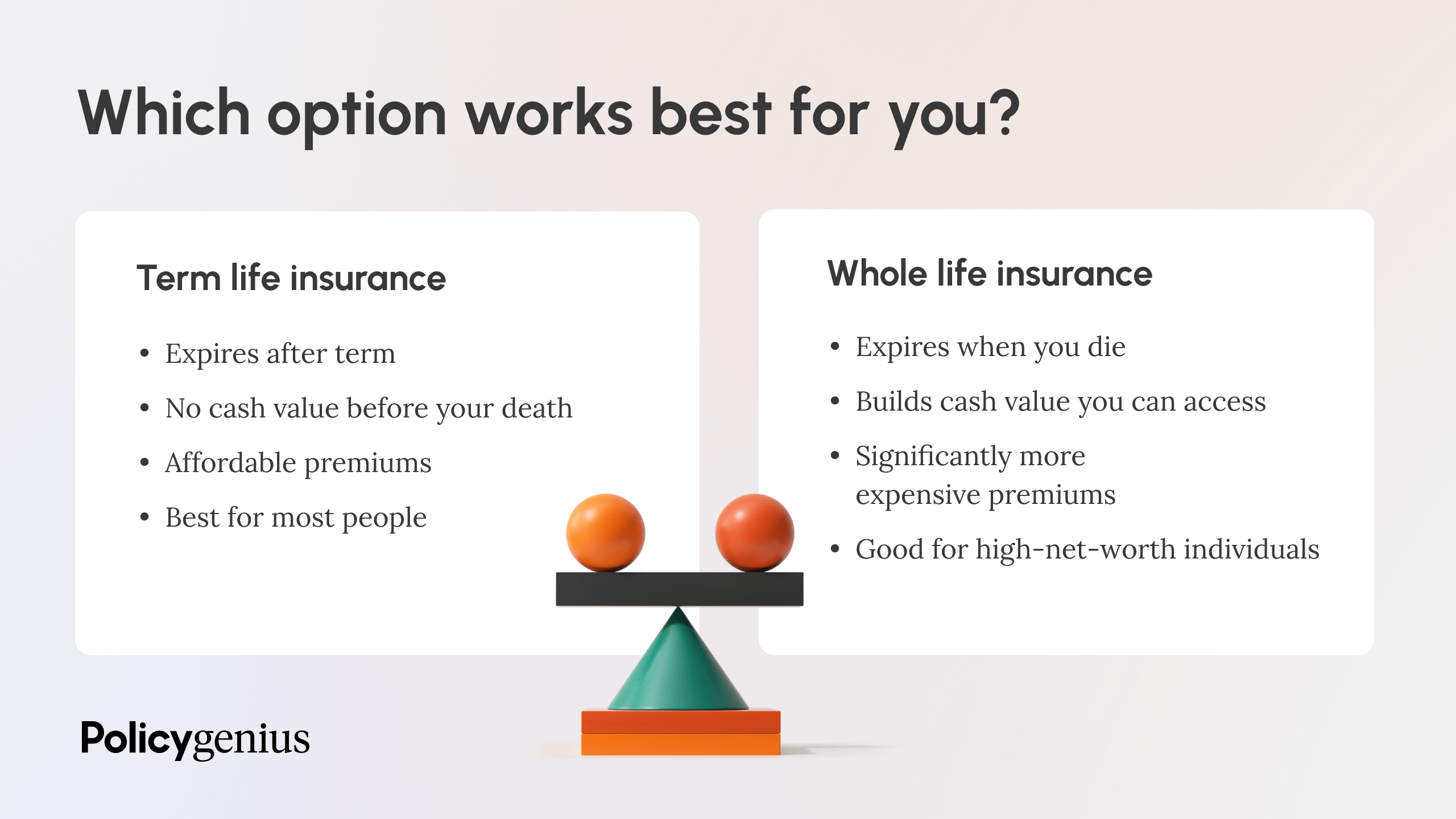

With degree term insurance coverage, the expense of the insurance coverage will remain the very same (or possibly reduce if rewards are paid) over the term of your plan, generally 10 or 20 years. Unlike long-term life insurance coverage, which never ends as lengthy as you pay costs, a level term life insurance policy policy will end at some time in the future, commonly at the end of the duration of your degree term.

What is Level Term Life Insurance? How It Works and Why It Matters?

Due to this, lots of people make use of permanent insurance as a stable monetary preparation device that can offer many needs. You might have the ability to transform some, or all, of your term insurance during a set period, commonly the initial 10 years of your policy, without needing to re-qualify for insurance coverage even if your health and wellness has actually transformed.

As it does, you might wish to include in your insurance policy coverage in the future. When you first obtain insurance coverage, you might have little financial savings and a huge home loan. Ultimately, your cost savings will grow and your home mortgage will certainly diminish. As this takes place, you might intend to ultimately reduce your survivor benefit or consider transforming your term insurance policy to a permanent policy.

Long as you pay your costs, you can relax easy understanding that your enjoyed ones will certainly obtain a fatality benefit if you pass away throughout the term. Several term plans permit you the ability to convert to long-term insurance without needing to take another health exam. This can enable you to capitalize on the fringe benefits of a permanent policy.

Level term life insurance policy is one of the most convenient paths into life insurance policy, we'll talk about the benefits and drawbacks so that you can select a plan to fit your demands. Degree term life insurance policy is the most typical and standard kind of term life. When you're seeking temporary life insurance policy plans, level term life insurance policy is one course that you can go.

You'll fill up out an application that includes general individual information such as your name, age, etc as well as a much more comprehensive questionnaire concerning your medical background.

The short solution is no., for instance, let you have the convenience of death benefits and can accumulate money worth over time, implying you'll have much more control over your advantages while you're active.

How Term Life Insurance Can Secure Your Future

Motorcyclists are optional provisions added to your policy that can offer you added benefits and protections. Anything can take place over the program of your life insurance term, and you want to be ready for anything.

There are circumstances where these benefits are developed into your policy, however they can additionally be offered as a separate addition that calls for additional payment.

Latest Posts

What is Joint Term Life Insurance Coverage Like?

What is the most popular Level Term Life Insurance Rates plan in 2024?

Why is Level Term Life Insurance important?