Featured

Table of Contents

That normally makes them a much more economical alternative for life insurance policy protection. Some term plans may not keep the costs and fatality benefit the exact same in time. Life Insurance. You do not wish to erroneously think you're buying level term coverage and after that have your survivor benefit modification in the future. Lots of people get life insurance policy coverage to aid economically safeguard their enjoyed ones in instance of their unanticipated fatality.

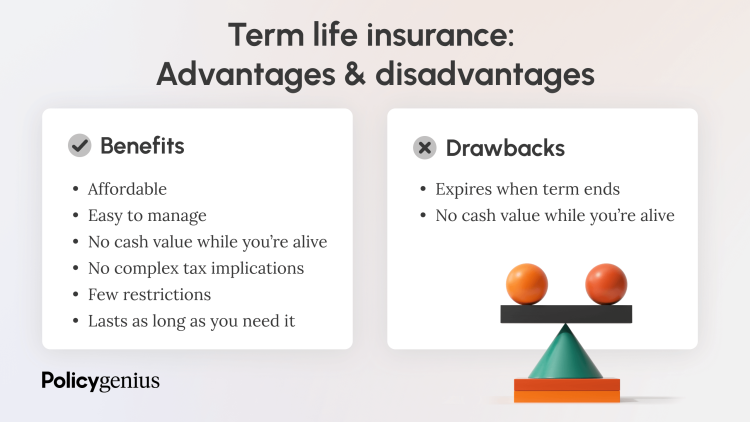

Or you might have the option to transform your existing term insurance coverage into an irreversible plan that lasts the rest of your life. Different life insurance policy policies have potential advantages and downsides, so it is necessary to comprehend each prior to you choose to buy a policy. There are several advantages of term life insurance policy, making it a popular selection for insurance coverage.

As long as you pay the costs, your recipients will get the survivor benefit if you die while covered. That stated, it is necessary to note that most policies are contestable for 2 years which means insurance coverage can be rescinded on fatality, ought to a misrepresentation be discovered in the application. Policies that are not contestable frequently have actually a graded fatality benefit.

What is What Does Level Term Life Insurance Mean? Comprehensive Guide

Costs are generally less than entire life policies. With a degree term policy, you can pick your protection amount and the plan length. You're not locked right into an agreement for the remainder of your life. Throughout your plan, you never need to stress over the costs or survivor benefit amounts changing.

And you can not pay out your plan throughout its term, so you will not get any financial benefit from your previous coverage. As with other kinds of life insurance policy, the price of a degree term policy relies on your age, coverage demands, work, lifestyle and wellness. Usually, you'll find much more budget friendly insurance coverage if you're more youthful, healthier and less high-risk to insure.

Considering that level term costs remain the exact same for the period of coverage, you'll know specifically just how much you'll pay each time. Level term protection additionally has some flexibility, enabling you to personalize your plan with added functions.

What is Direct Term Life Insurance Meaning? A Simple Explanation?

You might have to satisfy certain problems and credentials for your insurance provider to pass this cyclist. There likewise might be an age or time restriction on the protection.

The death advantage is normally smaller, and protection normally lasts until your child transforms 18 or 25. This rider might be a more affordable method to help guarantee your youngsters are covered as motorcyclists can typically cover several dependents at the same time. When your kid ages out of this coverage, it might be possible to transform the biker into a brand-new policy.

When comparing term versus long-term life insurance policy, it is essential to keep in mind there are a couple of different kinds. One of the most typical kind of permanent life insurance policy is entire life insurance coverage, yet it has some crucial differences compared to degree term protection. 10-year level term life insurance. Below's a fundamental introduction of what to consider when contrasting term vs.

Entire life insurance policy lasts forever, while term coverage lasts for a certain period. The premiums for term life insurance policy are generally lower than entire life insurance coverage. However, with both, the premiums stay the same for the period of the plan. Entire life insurance coverage has a cash worth element, where a portion of the costs may expand tax-deferred for future needs.

Among the primary features of degree term coverage is that your premiums and your survivor benefit don't transform. With reducing term life insurance policy, your premiums continue to be the very same; nevertheless, the survivor benefit quantity obtains smaller sized in time. You may have protection that starts with a fatality advantage of $10,000, which could cover a mortgage, and after that each year, the fatality advantage will reduce by a collection amount or percentage.

Due to this, it's frequently a more inexpensive kind of degree term protection. You may have life insurance policy via your company, but it might not be sufficient life insurance for your needs. The initial action when buying a plan is identifying exactly how much life insurance you require. Think about variables such as: Age Family dimension and ages Work standing Revenue Financial debt Way of living Expected final expenses A life insurance policy calculator can assist determine exactly how much you require to begin.

What Is Annual Renewable Term Life Insurance? The Complete Overview?

After selecting a plan, complete the application. For the underwriting procedure, you might have to offer general personal, wellness, way of life and employment information. Your insurance provider will identify if you are insurable and the risk you may provide to them, which is mirrored in your premium expenses. If you're accepted, sign the documentation and pay your initial costs.

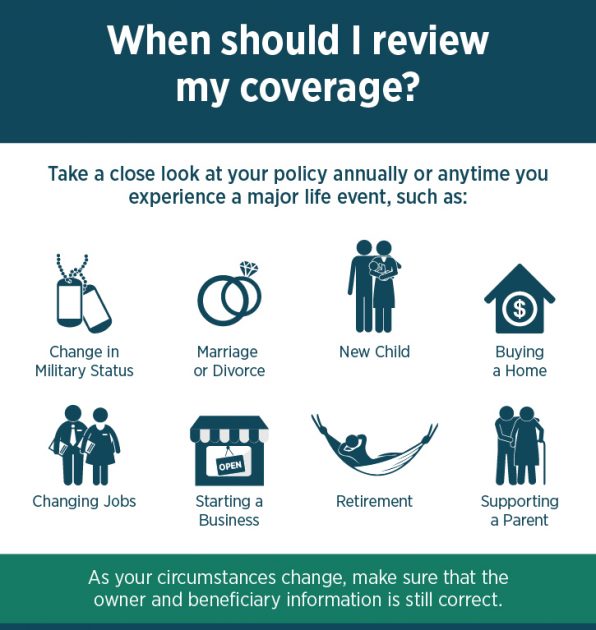

You might desire to update your beneficiary info if you have actually had any kind of considerable life modifications, such as a marital relationship, birth or divorce. Life insurance coverage can occasionally really feel complicated.

No, level term life insurance doesn't have money worth. Some life insurance policy plans have a financial investment attribute that permits you to construct cash value in time. A section of your costs repayments is alloted and can earn rate of interest in time, which grows tax-deferred during the life of your coverage.

Nonetheless, these policies are often considerably extra pricey than term insurance coverage. If you reach the end of your policy and are still alive, the insurance coverage ends. You have some options if you still desire some life insurance policy protection. You can: If you're 65 and your insurance coverage has gone out, for instance, you might intend to acquire a new 10-year degree term life insurance coverage plan.

Why Consider What Is Level Term Life Insurance?

You may be able to convert your term insurance coverage into an entire life policy that will last for the remainder of your life. Many kinds of level term plans are convertible. That indicates, at the end of your insurance coverage, you can convert some or all of your plan to entire life protection.

A level premium term life insurance coverage strategy allows you stick to your spending plan while you assist shield your household. ___ Aon Insurance Policy Services is the brand name for the broker agent and program administration procedures of Fondness Insurance policy Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Providers Inc.; in CA, Aon Affinity Insurance Policy Solutions, Inc .

Latest Posts

Secure Final Expense Scams

Instant Coverage Life Insurance

Instant Term Life Insurance Coverage