Featured

Table of Contents

"My recommendations is to purchase life insurance policy to cover the home mortgage in the event one of the home owners passes away prematurely (self assurance mortgage). Do not just purchase a quantity of life insurance policy equal to the mortgage quantity you have various other monetary bases to cover," Doug Mitchell, owner of Ogletree Financial, a life insurance agency

It does not cover anything else such as last clinical costs or funeral prices like a conventional life insurance policy policy. The reason it can not be used for anything else is due to the fact that the plan pays to your loan provider not your recipients. While standard policies pay out to your family members and can be used nonetheless they wish, MPI pays to your lending institution and only covers the price of your mortgage.

For several property owners, the mortgage is the largest economic responsibility they have. Some sort of home mortgage security is vital for property owners because it guarantees that your family members can continue staying in their home also if something unexpected happens to you. Obtaining ample coverage stops the threat of your family members facing repossession and supplies monetary stability during a tough time.

Yes, mortgage defense insurance normally covers the home loan in the occasion of your fatality. It pays the staying balance straight to the loan provider, guaranteeing that your family members can remain in the home without fretting about making home mortgage settlements. This insurance coverage can be a useful safeguard, avoiding repossession and supplying assurance throughout a hard time.

Choosing term policy offers choices for your family to either utilize the fatality advantage to pay off your house and utilize the leftover cash or perhaps skip paying the home loan and utilize the money as they like. If you are not qualified for term coverage, a home loan insurance coverage policy is a good choice.

Mortgage Protection Insurance Policy

For a lot of people, a term life insurance policy is the superior choice. It is more affordable, extra safety, and extra adaptable than most mortgage protection insurer. Age Age 16 20 21 24 25 34 35 44 45 54 55 64 65+ Protection Quantity Insurance Coverage Quantity $50,000 $100,000 $100,000 $200,000 $200,000 $300,000 $400,000 $500,000 $500,000 $1,000,000 $1,000,000 $2,000,000 $2,000,000 $5,000,000 $5,000,000+ Protection Type Insurance Coverage Kind Whole Life Term Life Final Cost Uncertain Sex Sex Male Women Non-Binary.

This is one of the most significant investments you'll make in your life. And since of the time and money you've invested, it's additionally one of the most vital actions you'll take in your life time. You'll want to make certain that your dependents are covered in case you die before you pay off your home mortgage.

They may draw in debtors who are in inadequate health and wellness or who have inadequate medical histories. Mortgage life insurance policy is a special kind of insurance plan used by banks that are affiliated with lending institutions and by independent insurance coverage companies. It's not like various other life insurance coverage policies. As opposed to paying a survivor benefit to your beneficiaries after you die as conventional life insurance does, home loan life insurance policy only repays a mortgage when the borrower dies as long as the car loan still exists.

State Farm Mortgage Protection Insurance

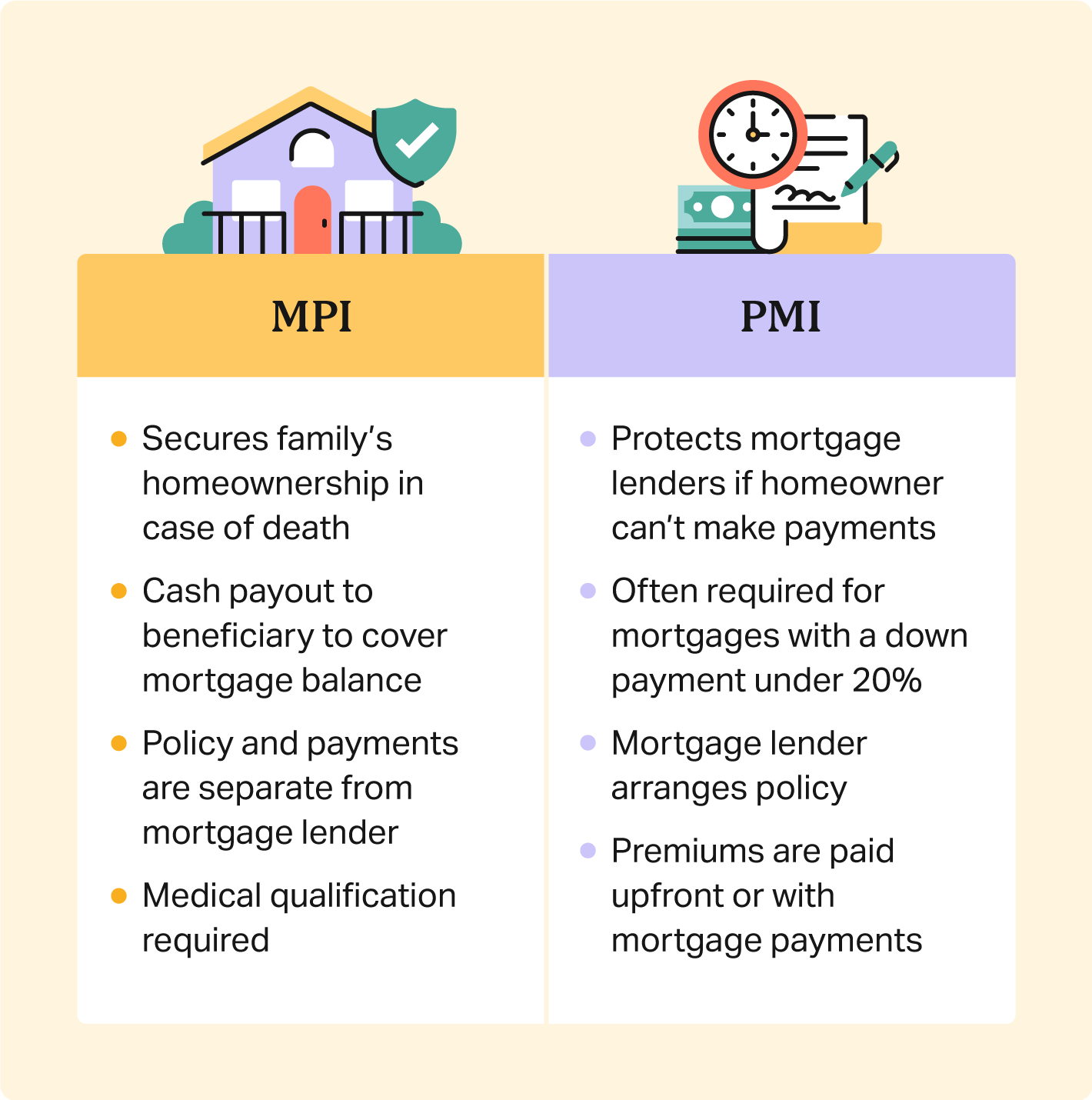

If there's no mortgage, there's no payback. While home loan life insurance can shield youthe borrowerand their heirs, home loan insurance policy protects the lending institution if the debtor isn't able to fulfill their economic obligations.

Mortgage life insurance policy is not home mortgage insurancethe last secures the lender in situation the consumer defaults on their mortgage for any kind of factor. When you have actually closed on your loan, watch for routine mailouts and telephone call attempting to offer you a mortgage life insurance policy. These solicitations are typically camouflaged as official requests from home loan lenders.

The very first one is a declining payment plan, where the policy size reduces proportionally as the mortgage loan declines. The closer it is to zero, the payment goes down, too. The other type of home mortgage life insurance policy is called degree term insurance policy. With this sort of policy, the payout doesn't reduce.

Another possibility is to obtain a plan that offers more insurance coverage for a less costly price earlier in your home mortgage term. Some plans may return your costs if you never file a claim after you pay off your mortgage.

Plus, you will certainly have likely squandered the chance to spend any kind of cash you would certainly have conserved, had you bought less expensive term life insurance coverage. Actually, home loan defense life insurance plans are usually foolhardy. Firstly, there's no versatility. Unlike routine term life insurance coverage, where beneficiaries might utilize insurance payouts as they choose, the majority of insurance companies send out benefit payments straight to loan providers, so your beneficiaries never ever see any cash.

This sort of mortgage life insurancewhich is in some cases described as reducing term insuranceis created to repay your home mortgage equilibrium, while every month your beneficiary pays down part of your mortgage principal. Consequently, the policy's possible payment reduces with every mortgage repayment. On the various other hand, some newer items have an attribute called a degree death benefit where payments don't decrease.

Mortgage Insurance How Does It Work

A better remedy is to just buy even more life insurance policy. Those concerned concerning leaving behind expensive home mortgages to their loved ones should consider term life insurance policy, which is a normally exceptional service to mortgage protection life insurance policy.

All of us wish to guarantee our liked ones are financially secured. That does not indicate everybody desires protection for the same reasons. So it makes sense that there's various kinds of insurance to choose from. This article takes into consideration mortgage defense insurance coverage, life insurance policy and home loan life insurance policy. Exactly how does home loan life insurance policy vary from a typical life insurance policy plan? Both of these kinds of life insurance coverage can be used for home mortgage defense functions, however that does not tell the whole tale.

Life insurance policy is usually a policy that supplies level cover if you pass away throughout the length of the policy. Simply put, the amount of cover stays the very same until the plan ends. If you're no more around, it can supply security for a home loan, and undoubtedly any purpose, such as: Aiding enjoyed ones pay the home costs Supporting kids with college Paying the rent (not just home loan defense).

For the function of the remainder of this article, when speaking about 'mortgage life insurance' we are describing 'lowering home mortgage life insurance policy'. Simply remember that life insurance is not a cost savings or investment product and has no cash worth unless a valid insurance claim is made.

If you're healthy and have never ever utilized cigarette, you'll normally pay even more for mortgage security insurance than you would for term life insurance coverage. Unlike other kinds of insurance, it's tough to get a quote for home mortgage defense insurance policy online. Prices for mortgage security insurance policy can differ widely; there is much less openness in this market and there are way too many variables to accurately contrast costs.

Term life is an excellent choice for home loan protection. Policyholders can gain from a number of benefits: The amount of protection isn't restricted to your mortgage equilibrium. The death payout stays the very same for the term of the policy. The recipients can utilize the plan continues for any type of purpose. The policy uses a death benefit also after the mortgage is repaid.

Cheapest Life Insurance For Mortgage

You may desire your life insurance policy to shield even more than just your home mortgage. You choose the policy worth, so your coverage can be a lot more or less than your home loan balance.

If you're guaranteed and die while your term life policy is still energetic, your picked enjoyed one(s) can utilize the funds to pay the mortgage or for one more objective they pick. There are many advantages to utilizing term life insurance to protect your home mortgage. Still, it might not be an ideal solution for everyone.

Yes and no. Yes, due to the fact that life insurance policy plans tend to straighten with the specifics of a mortgage. If you buy a 250,000 house with a 25-year mortgage, it makes feeling to get life insurance policy that covers you for this much, for this lengthy. That way if you pass away tomorrow, or any time during the next 25 years, your home loan can be removed.

Private Mortgage Insurance Vs. Homeowners Insurance

Your family or recipients receive their lump amount and they can invest it as they like. It is very important to comprehend, however, that the Home mortgage Defense payment amount reduces in line with your home mortgage term and balance, whereas level term life insurance policy will certainly pay out the very same lump sum at any moment throughout the plan size.

You might see that as you not getting your payout. On the other hand, you'll be to life so It's not like paying for Netflix. You do not see an obvious or upfront return wherefore you purchase. The sum you invest on life insurance policy on a monthly basis does not pay back till you're no more here.

After you're gone, your liked ones don't have to stress regarding missing out on repayments or being unable to manage living in their home. There are two major varieties of home loan protection insurance coverage, level term and reducing term. It's always best to obtain recommendations to establish the policy that best talks with your needs, spending plan and situations.

Latest Posts

Secure Final Expense Scams

Instant Coverage Life Insurance

Instant Term Life Insurance Coverage